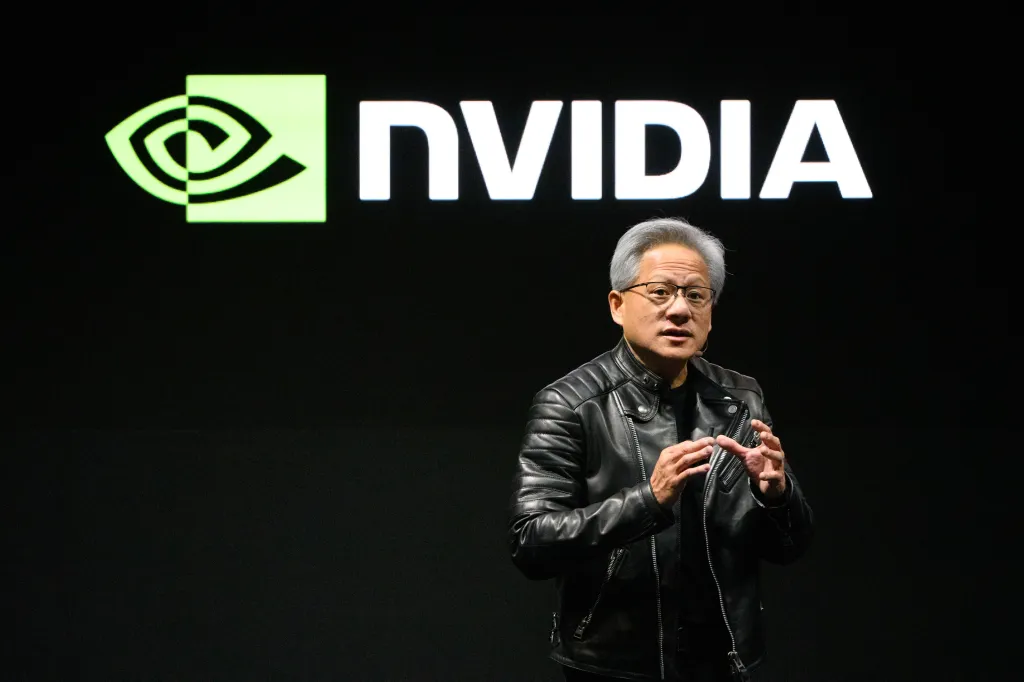

Nvidia’s $4T Triumph: Can Jensen Huang’s AI Vision Push Stocks Even Higher?

On July 9, 2025, Nvidia made history by becoming the world’s first publicly traded company to reach a $4 trillion market valuation, surpassing tech giants Apple and Microsoft. This milestone, driven by a 2.5% surge in stock price to $164, marks a staggering 1,500% growth over the past five years, fueled by Nvidia’s dominance in the artificial intelligence (AI) revolution. Under the leadership of CEO Jensen Huang, Nvidia has transformed from a niche graphics chipmaker into the backbone of global AI infrastructure, powering everything from data centers to autonomous vehicles. With quarterly revenues soaring to $44.1 billion and projections of a $6 trillion valuation by 2028, investors and analysts are buzzing with a critical question: Can Huang’s ambitious AI vision propel Nvidia’s stocks even higher, or is the chipmaker nearing the peak of its meteoric rise? As the company navigates challenges like export restrictions and market volatility, its future hinges on Huang’s bold bets on AI, robotics, and beyond.

The AI Boom: Nvidia’s Rocket Fuel

Nvidia’s ascent to a $4 trillion valuation is inseparable from the global AI gold rush. Originally known for its graphics processing units (GPUs) tailored for gaming, Nvidia pivoted under Huang’s leadership to capitalize on the computational demands of AI. Its GPUs, particularly the H100 and the newer Blackwell series, have become the gold standard for training and running large language models (LLMs) and generative AI applications used by tech titans like Microsoft, Google, Amazon, and OpenAI. In its fiscal 2026 first quarter (ended April 27, 2025), Nvidia reported $44.1 billion in revenue, a 73% year-on-year increase, with its data center segment alone contributing $39.1 billion. Gross margins above 70% have earned Nvidia the moniker of a “profit machine” on Wall Street, reflecting its unparalleled pricing power in the AI supply chain.

Huang’s vision extends beyond current AI applications. At Nvidia’s GTC conference in March 2025, he unveiled the Blackwell Ultra GPU, designed to handle advanced “reasoning” AI models that autonomously refine outputs for greater accuracy. These models, which consume up to 1,000 times more computational tokens than earlier LLMs, underscore the growing demand for Nvidia’s high-performance chips. Huang predicts that global AI infrastructure spending could reach $1 trillion annually by 2028, driven by the need for “AI factories”—data centers that produce AI-driven insights as valuable as electricity or the internet. With Nvidia commanding an estimated 80% of the AI chip market, its role as the linchpin of this transformation is undisputed.

Beyond Data Centers: Robotics and Autonomous Vehicles

While Nvidia’s data center dominance grabs headlines, Huang sees another trillion-dollar opportunity in robotics and autonomous vehicles. The company’s automotive segment, though currently a small fraction of its revenue at $1.7 billion in fiscal 2025, is projected to reach $5 billion in fiscal 2026, a 194% increase. Partnerships with General Motors, Tesla, and others highlight Nvidia’s push into self-driving technology, leveraging its DGX data center systems and the Cosmos multimodal AI model, pre-trained on 20 million hours of video for real-world understanding. These tools enable carmakers to refine autonomous driving systems through simulations, reducing reliance on physical testing.

Huang’s vision for “physical AI” extends to humanoid robots and robotic factories, areas where Nvidia’s Isaac GR00T platform and Newton physics engine, developed with partners like DeepMind and Disney, aim to accelerate innovation. Posts on X reflect investor excitement, with users like @StockSavvyShay noting that “AI and robotics are Nvidia’s biggest trillion-dollar bets,” signaling confidence in Huang’s long-term strategy. However, the automotive segment’s growth depends on widespread adoption of autonomous vehicles, which faces regulatory and technological hurdles, making it a riskier bet than Nvidia’s established data center business.

Challenges and Headwinds

Nvidia’s triumph has not been without turbulence. In early 2025, its stock plummeted 37% between January and April, triggered by Chinese AI startup DeepSeek’s unveiling of a cost-effective AI model that raised doubts about the necessity of high-end chips. U.S. export restrictions on AI chips, particularly Nvidia’s H20 model, further dented growth, costing the company an estimated $4.5 billion in missed revenue in China, which accounted for 13% of its fiscal 2025 revenue. Despite these setbacks, Nvidia’s shares rebounded 74% from April lows, bolstered by investor confidence in its long-term prospects.

Geopolitical tensions, including ongoing U.S.-China trade disputes and potential tariff increases under President Donald Trump, pose ongoing risks. Huang has expressed concerns about the loss of the Chinese market, noting on a May 2025 CNBC appearance that it represents a “tremendous” opportunity for American jobs and revenue. Additionally, competition from rivals like AMD and Broadcom, as well as in-house chip development by hyperscalers like Google, could erode Nvidia’s market share. The cyclical nature of data center capital expenditure, vulnerable to economic downturns, also looms as a potential brake on growth, as highlighted by The Motley Fool.

Financial Firepower and Philanthropic Impact

Nvidia’s financial strength underpins its market dominance. With a price-to-earnings (P/E) ratio of 44.3 and a forward P/E of 26, analysts argue that Nvidia’s stock remains attractively valued compared to its growth trajectory, especially with projected 50% earnings per share growth in 2025. Barclays recently raised its price target to $200, suggesting a potential $5 trillion valuation, while Loop Capital predicts $6 trillion by 2028, citing Nvidia’s monopoly-like grip on AI compute. The company’s CUDA software platform and networking solutions, such as NVLink, further lock customers into its ecosystem, creating a high barrier to switching.

Beyond profits, Huang’s personal wealth and philanthropy have soared alongside Nvidia’s success. His net worth, estimated at $140 billion by Bloomberg’s Billionaire Index, ranks him among the world’s richest. The Jensen and Lori Huang Foundation, fueled by donations of Nvidia stock, grew from $828 million to $9.1 billion in assets over five years, placing it among America’s largest charitable foundations. Huang’s planned sale of 6 million shares in 2025, valued at $810 million under a Rule 10b5-1 plan, reflects a strategic move to diversify his wealth without signaling a lack of confidence in Nvidia’s future.

Investor Sentiment and Market Outlook

Investor sentiment, as seen on X, remains bullish. @The_AI_Investor highlighted Loop Capital’s raised price target of $250, driven by projected $2 trillion in generative AI compute spending by 2028. Meanwhile, @wallstengine emphasized Nvidia’s leadership in “agentic AI,” capable of autonomous task execution, as a key growth driver. However, some caution persists. The Motley Fool noted that investor enthusiasm waned after Nvidia’s Q4 earnings, despite 78% revenue growth, due to macroeconomic concerns and trade war fears. The stock’s brief dip below $4 trillion to $3.99 trillion after its July peak underscores its volatility.

Analysts like Wedbush’s Dan Ives see Nvidia as the “backbone of the AI revolution,” predicting that Microsoft could join it at $4 trillion soon. Huang’s partnerships, including Project Stargate—a $500 billion AI infrastructure initiative backed by Trump—signal Nvidia’s growing geopolitical influence. Yet, skeptics warn that a potential recession or oversaturation of AI infrastructure spending could cap gains, especially if returns on AI investments falter.

Conclusion

Nvidia’s $4 trillion triumph is a testament to Jensen Huang’s visionary leadership and the insatiable global demand for AI. The company’s dominance in data center GPUs, coupled with its ambitious forays into robotics and autonomous vehicles, positions it for continued growth. While challenges like export restrictions, competition, and economic cycles loom, Nvidia’s financial strength, innovative roadmap, and ecosystem lock-in provide a robust foundation. With analysts projecting valuations as high as $6 trillion by 2030, and Huang’s unwavering belief that “AI is just beginning,” Nvidia’s stock has room to climb—provided it navigates geopolitical and market headwinds. For investors, the question isn’t whether Nvidia will remain a leader, but how high Huang’s AI vision can take it in a world increasingly powered by intelligent machines.

Last Updated on: Wednesday, July 9, 2025 10:45 pm by Tamatam charan sai Reddy | Published by: Tamatam charan sai Reddy on Wednesday, July 9, 2025 10:44 pm | News Categories: Business